FHA vs. Conventional Mortgages: Which Is Right for You?

FHA vs. Conventional Mortgages: Which Is Right for You?

When you start dreaming about homeownership, one of the first big questions you’ll face is: which mortgage is right for me? With so many options out there, it can feel a little overwhelming. Two of the most common choices in North America are FHA and conventional loans. Let’s break down what makes each unique, so you can take your next step with confidence!

FHA Loans: Opening Doors for Many

FHA loans are backed by the Federal Housing Administration, making them especially popular among first-time buyers or those with lower credit scores. The government guarantee means lenders are more willing to approve these loans, even if your financial profile isn’t perfect.

- Lower down payments: You could put down as little as 3.5%.

- Flexible credit requirements: FHA loans are generally available to buyers with credit scores as low as 580.

- Mortgage insurance: You’ll pay an upfront premium and ongoing monthly insurance, which protects the lender.

Best for: Buyers with modest savings or less-than-stellar credit, or anyone who needs a little extra help getting into the market.

Conventional Loans: The Classic Choice

Conventional loans are not backed by the government. Instead, they’re offered by private lenders and usually require a stronger financial profile.

- Higher credit standards: Most lenders look for a score of 620 or higher.

- Flexible terms: You can choose from a variety of loan lengths and structures.

- Private mortgage insurance (PMI): Required if your down payment is less than 20%, but can be removed once you reach enough equity.

Best for: Buyers with solid credit, steady income, and enough savings for a larger down payment.

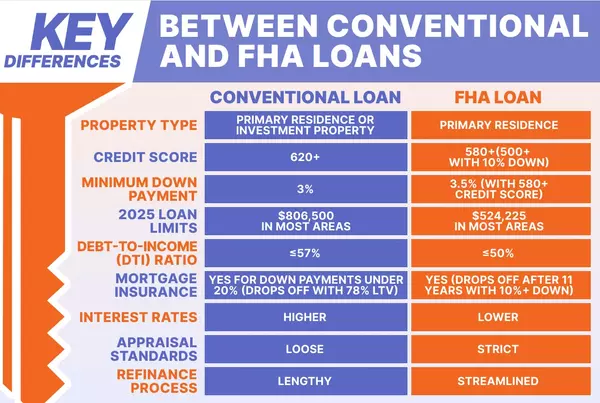

FHA vs. Conventional: What’s the Difference?

- Down payment: FHA’s 3.5% minimum vs. conventional’s 3–20% (with 20% avoiding PMI).

- Credit score: FHA is more forgiving; conventional is stricter.

- Mortgage insurance: FHA requires it for the life of the loan (in most cases), while conventional lets you cancel PMI once you have enough equity.

- Loan limits: FHA loans have lower maximum amounts compared to many conventional options.

The People Who Help: MLOs vs. Mortgage Brokers

When you’re ready to apply, you’ll likely work with either a Mortgage Loan Officer (MLO) or a mortgage broker. But what’s the difference?

- Mortgage Loan Officer (MLO): Works for a specific bank or lender and offers only that institution’s loan products. If you already have a relationship with a bank, an MLO can guide you through their process.

- Mortgage Broker: Acts as a matchmaker, shopping your application around to multiple lenders to find the best fit. Brokers can often offer a wider range of options and may help you secure better rates or terms.

Both professionals are licensed and knowledgeable, and both can help you navigate FHA and conventional loans. The right choice depends on whether you want to compare multiple lenders or stick with one you know and trust.

Which Is Right for You?

There’s no one-size-fits-all answer. It really depends on your financial situation, your long-term plans, and what you feel most comfortable with. If you’re unsure, don’t hesitate to reach out to a mortgage professional—they can walk you through the numbers and help you make the best choice for your future.

Homeownership is a big step, but with the right information and support, you’ll be unlocking your front door in no time! 🏡

Recent Posts